This article was originally published on April 21, 2015, and was updated on April 19, 2020.

In the first season of The Muppet Show, Kermit was quick to tell us that “it’s not easy being green.” Well, he may have had a point back then, but now it’s easier than ever to start thinking green — especially with a .green domain name.

This year marks the 50th anniversary of Earth Day, and a website address that ends in the .green domain extension is a great way to honor your commitment to a greener, more sustainable environment.

You’re on the up and up when it comes to global warming. You’ve tracked your carbon footprint and you’re aware of your energy consumption.

With Earth Day around the corner, a website address that ends in .green is a great way to showcase that mission.

Green living at a glimpse

A .green domain name can immediately identify you as earth-friendly. From the moment people see your website address, they’ll know you embrace environmental causes.

A .green domain name can immediately identify you as earth-friendly. From the moment people see your website address, they’ll know you embrace environmental causes.

Whether you manufacture wind turbines, design LEED-certified buildings, blog about sustainable farming, or volunteer planting trees from coast to coast, use .green to show the world what you do. Plus, .green is perfect for a companion website about your company’s earth-friendly practices.

Securing your own .green domain name is just another natural step in this environmental movement.

A domain name that sticks

The .green domain is exclusive and relatively new to the domains market, so you’ve got a fantastic chance of securing a shorter, more memorable web address that still holds true to your green identity.

Going .green means you can select a universally recognized domain name with an emphasis on bettering our environment — all without compromising the length and ingenuity of your name.

With your one-of-a-kind domain name in hand, it makes it that much easier to start the conversation about going green.

Ready to go .green? Give it a try:

SEARCH Green means business

If you’re looking to boost your online presence, .green might be the way to go. A recent Google search for the term “green” showed more than 25 billion (yes, with a “b”) results.

Our society is demanding more environmentally sound options and practices across the board.

With so many people out there looking to go green, it’s prime time to capitalize on this ever-growing market. A Nielsen study found that “the majority of consumers will pay more for products offered by socially and environmentally conscious firms, while the majority of employees prefer to work for these firms. This is increasingly true for younger stakeholders.”

Being environmentally conscious pays in more than one way — and you want to be sure your customers know you’re aware of the trend. You can gain that recognition and build green credibility for your business online with a .green domain.

Related: How to make a difference with your small business this Earth Day and every day

The post Color your website earth-friendly with a .green domain name appeared first on GoDaddy Blog.

Read more: godaddy.com

At some point in this day and age, it’s likely you’ll find yourself with a domain you own, but no longer need. Instead of letting that domain expire, why not try to sell it? You could be sitting on your own private gold mine. Early retirement might not be possible with only a few domain names for sale, but you could still get some spending cash.

After all, if you were to end your business, you wouldn’t just throw away your extra products or materials — you’d capitalize on your investments and sell them.

In fact, there are people, and even businesses, who invest in buying domains on a regular basis. Whether you’re an investor with thousands of domains or just have one you no longer want to keep, you have options.

There are powerful tools available to help you get top dollar for your domain assets.

Still not convinced? Take a look at some of these top domain sales for 2019, courtesy of dnjournal.com:

Voice.com — $30 million California.com — $3 million Nursing.com — $950,000

You could be sitting on a gold mine. Will your domain be worth as much as these? Maybe not, but you never know! The best way to find out is to use some of these useful online tools to track domain names for sale. That way, you’ll have an idea of what your name might be worth.

Related: The top 25 most expensive domain names

Keeping tabs on domain names for sale

Before you list your hidden gem on the market, do some research and find a good target price range.

NameBio. The best single location for checking public domain name sales prices. You can even tailor your search to highlight similar terms found in your own domain name. You’ll be able to see firsthand how domains have sold historically, and these comps can give you a good estimate for your domain’s worth.

Estibot. This site attempts to give you an automated, free appraisal of your domain. Just be sure to use this in conjunction with outside research. It’s nice to have a quick answer, but watching historical trends and sales is always useful.

GoDaddy Domain Name Value & Appraisal. With over 20 years of domain aftermarket experience powering this tool, you can quickly and easily get a free estimate of what your domain might be worth on the domain aftermarket.

Using these tools, you can get a better understanding of your domain’s worth. At the end of the day, all domains are unique. List your domain at a price that you would be happy selling at.

Posting domain names for sale

After you’ve checked the tools and are ready to price your domains, it’s time to actually list them. At GoDaddy, you have the option to list your domain names for sale via Premium Listings and GoDaddy Auctions.

Premium listing

Premium domains are listed with a Buy Now price, and once they’re sold they instantly leave your account and move automatically to the buyer. They show up for sale on GoDaddy when customers come to search for an available domain name to buy.

The premium domain will also automatically list your domain on the GoDaddy auctions in most cases.

GoDaddy Auctions

When selling a domain name through GoDaddy Auctions, you can list your domain name a number of ways:

Create a minimum reserve price

Using the traditional, seven-day auction method, you can sell your domain to the highest bidder once it closes — so long as the final offer meets or exceeds your price (this is similar to eBay auctions).

Sell without a set price

Using an offer/counter-offer setup, you can entertain bids and negotiate pricing to suit your needs. The domain name will sell only if you agree to an offer price from the interested party.

Related: 5 tried-and-true tips for buying and selling domain names for profit

Afternic

If you really want to supercharge your ability to sell a domain, Afternic is the option you should choose. Even though this platform is typically utilized by professionals, it’s open to anyone — and the cost is the same as simply listing your domain names for sale with GoDaddy. It’s a no-brainer for someone serious about selling their domains.

Listings through Afternic will appear on more than 100 partner registrars throughout the world.

If they are listed with a Buy Now price, they’ll also appear as a premium listing at GoDaddy.

Better yet, a Buy Now domain will appear on more than 100 partner registrars all over the world in addition to GoDaddy. That includes nine out of the top 10 most popular registrars. And to top it all, managing your listing is easy. Don’t worry about having an account across all 100 registrars — update, manage and handle your listing with ease with Afternic, and watch your domain spread across the network.

Listing at GoDaddy is good, but listing at Afternic is better. Along with the increased exposure, you get access to Afternic’s sales team — experts ready and willing to field questions from buyers about your domain name. They even help to seal the deal! And since Afternic is owned by GoDaddy, you’re guaranteed to get the same great customer support.

In conclusion

Have any domain names that are hiding in your account? Do some research and see what they could be worth.

Then, head on over to GoDaddy or Afternic and start listing. Why wait? Start selling your domains today and put a little extra money in your pocket.

The post How to list domain names for sale appeared first on GoDaddy Blog.

Read more: godaddy.com

There’s a new way to do things online, and the top-level domain (TLD) .new is behind it. Google is the registrar for the .new domain. You might have already seen it used with different Google apps.

Who Gets a .new Domain?

Anyone will be able to register a .new domain, but there are conditions that are unique in the TLD world.

To register a .new domain, it must be used to start an action in a process or content creation. It has to engage the user immediately in the creative action. It must be available to the public within 100 days of registering the domain.Google must be allowed to verify the domain’s action at no cost to Google. That means, if it’s a membership process, then Google doesn’t have to pay for the membership just to test it.

To register a .new domain, it must be used to start an action in a process or content creation. It has to engage the user immediately in the creative action. It must be available to the public within 100 days of registering the domain.Google must be allowed to verify the domain’s action at no cost to Google. That means, if it’s a membership process, then Google doesn’t have to pay for the membership just to test it.

Some of the biggest names on the Internet have already snapped up their domains and put them to use.

If you’re not using Canva for making online and print graphics, you should check them out. To make it simpler to start creating a new design, Canva acquired the canva.new and design.new domains. Both lead directly to Canva’s online graphic design tool.

Spotify is all about music and podcasts, so they snatched up the domains playlist.new and podcast.new. As you guessed, playlist.new initiates the building of a new playlist for you.

Podcast.new will tie you into Spotify’s podcast creation service, Anchor, and you can set up your new podcast. If you’re already casting on Anchor, podcast.new will take you to the new episode creation site.

If you haven’t used Webex, it’s worth checking out as a way to host online meetings or share someone’s screen to give them tech support.

Cisco, owners of Webex, have registered webex.new, letsmeet.new, and mymeet.new. All of these point to the same place to start a new Webex meeting or download the Webex app.

Processing online payment is what Stripe does best. By getting the invoice.new and subscription.new domains, Stripe has taken it just a step further.

Using invoice.new, you’re taken instantly to create a new invoice on Stripe. Using subscription.new takes you to add a customer to your subscription service to collect recurring payments.

Using the story.new domain will take you to Medium’s story editing page if you have an account. If you don’t have an account, it will first take you to the sign-up page.

Medium continues to grow as a prime spot for budding bloggers and seasoned journalists. Using story.new just makes it one step easier.

Amongst the one name luminaries of the world, there’s a solo Canadian named Drake. You might have heard of him. Drake and friends have a record label called OVO, and grabbed music.new to help promote their artists.

Go to music.new and you can lightly edit a cover to a song by changing the text. We can only assume this was the minimum effort to get the domain to be used for something much cooler later.

More for the coder crowd, RunKit allows coders to work with the node.js platform online, in a sandboxed, safe, environment. It really is a powerful development tool.

RunKit picked up api.new to streamline access to their Application Programming Interface (API) creation tool.

It’s kind of meta that a URL shortening business has acquired domains to shorten their own URLs.

Bitly is the service you use when you want to change a link from something like http://www.onlinetechtips/cool-article-about-the-.new-domain?variable=fasdnaow4b47oaibouyib to something more like http://bit.ly/whats.new.

Get your short links quicker with link.new or bitly.new.

Think of Coda as a sort of Google-Docs-meets-whiteboard-meets-a-team-collaboration app. If that sounds like something you could use, or if you’re using Coda already, try the coda.new domain to start a new document.

You know eBay. Outside of Amazon, it’s the one place to shop on the web where everybody knows the name. Selling one item or setting up a new shop, eBay has a .new domain for you.

To sell something, go to the sell.new domain or to set up a whole shop go to the shop.new domain.

As the repository for so much open source code on the web, GitHub is like the Library of Alexandria for programmers. It’s no surprise that Microsoft bought it. It’s also no surprise that GitHub runs the repo.new and gist.new domains.

Of course, repo.new generates a new repository and gist.new creates a new gist. Think of a gist as being a place to store a small chunk of code, while a repository is for a whole coding project. These .new domains will help you to get the most out of GitHub.

OpenTable is to restaurant reservations as Uber is to ride-sharing. For the starving diner, there’s the reservation.new and restaurant.new to quickly book your next food experience. Either will take you directly to the reservation booking page.

So What Else Is .new?

There will be many more .new domains to come. It’s still in the early days as Google only opened registrations for the .new TLD in October for established brand names.

In December 2019, limited registration will be available for those that wish to apply. Then in July 2020, anyone can register without having to apply. They’ll still need to satisfy the registration criteria, though.

Is .new Worth It?

It’s too new to tell. At $550 per domain, it’s worth it to the big names, but to the lone website owner, it might not be. Right now, it appears that the .new domains are being used simply as redirects to already existing and pretty easy to access features.

Until 2020, when truly creative people can get their hands on the domain, we just don’t know what can really be done with it.

Read more: online-tech-tips.com

Cyber threats are having a significant impact on businesses — that much is clear. Budget and resources are being dedicated to securing infrastructure and applications, and educating staff on the dangers of phishing, malware and social engineering. For marketers, cyber security is quickly encroaching on brand protection as a whole, and rightly so. The lines between the two areas are blurring and in the future it is conceivable that the two disciplines are far more integrated than they are now.

But what about domains? How does domain security factor into wider online brand protection initiatives? While domain registration, renewal and management are an integral part of online brand protection, does security gain the same attention?

Regardless of the current approach, marketers should be focused on this aspect, especially seeing as the threat is increasing in the domain name system (DNS) space. Historically this wasn’t a target for cyber criminals or hackers, but as they become bolder and more sophisticated, nothing is off limits.

What’s the damage?

In an internet-enabled world, any issues with a brand’s website can have potentially devastating consequences, from loss of sales and revenue, to diminished customer trust. So how can hackers cause damage and disruption by launching a domain attack? Firstly, they can take your website offline. No website means no customers and no sales. Secondly, they can redirect traffic from your website to another one that may look like yours. In this way they can capture customer data, such as personal information or payment card details, or they can use the misdirection to sell counterfeit goods. Lastly, they could also possibly hack into your DNS account and transfer your domain away from your organisation.

Domain protection

Given the importance of domains, what should brands do to secure them and mitigate the risk?

Work with the right corporate registrar

Choosing the right corporate registrar is the first step in a domain security plan. The right register will have hardened security practices in place and an excellent understanding of the landscape, the threats and the ways to mitigate them. Such a registrar will also have specialised security features for preventing, detecting and responding to attacks against any domains, including:

Restricting access to a portal via an IP address Sending notifications on any name changes Avoiding automated emails as a primary means of communication Keeping activity logs to track all domain name updates Maintaining strong password management to force password changes Offering multiple levels of access Consolidate your portfolio

The best way of securing your domains is to know which ones you own — maintain careful records of all domain names across all your brands, offices and locations. Ideally, this should be a centralised, global view to ensure you’re always looking at the whole domain picture.

Monitor critical domains

It’s also important to constantly monitor the domains that are core to your brand. Again, working with the right registrar can help here, as they can monitor for differences between the nameservers stored at the registry compared to the nameservers stored in their databases. A mismatch could be the first sign someone has broken into a registry system and made an unauthorised update.

Use two-factor authentication as standard

When accessing a domain management portal or DNS management portal, use two-factor authentication because it provides an extra layer of security that requires not only a password and username, but also something that only the user can give, such as a one-time password via a physical token.

Use domain locking

To mitigate the threat of domain name hijacking, you should ensure your domains are locked. This means they can’t be transferred. Taking this a step further, you should also implement registrar locking, which is an elevated locking mechanism that freezes all domain configurations until the registrar unlocks them upon completion of a customer-specified security protocol. This should be applied to your most mission-critical domains such as transactional sites, email systems, intranets and site-supporting applications.

Moving forward

The threat that cyber criminals and hackers pose to brands shows no sign of abating. While the consequences of an attack could be severe for an organisation, there are ways to mitigate the risk, especially when it comes to domain security. Importantly, domain security needs to be considered as part of a much wider online brand protection strategy that also takes the cyber threat into account. As a result, working with the right partners and having the right processes in place can position your organisation to effectively deal with the threat.

Interested in hearing leading global brands discuss subjects like this in person?

Interested in hearing leading global brands discuss subjects like this in person?

Find out more about Digital Marketing World Forum (#DMWF) Europe, London, North America, and Singapore.

Read more: marketingtechnews.net

Why should you care about domain authority?

By now, you realize just how important it is for your site to be visible in search engines.

Search engines like Google are the primary mode of discovery for billions of users, so if you can get your site at or near the top rankings for relevant keyword phrases, you can secure an ever-growing stream of new traffic to your website.

But many online business owners neglect a fundamental element of search engine optimization (SEO) strategy: domain authority.

Learning how to increase domain authority and using a good domain authority checker can dramatically improve your overall SEO results.

In this guide, you’ll learn the intricacies of how domain authority is calculated, why domain authority matters, and of course, the strategies you need to be successful in improving it.

Related: Beginner’s guide to search engine optimization for small business websites

What is domain authority?

Let’s start with a basic outline of what domain authority is and how it functions.

Domain authority is a cumulative score of trustworthiness for a given web domain.

When search engines formulate search engine results pages (SERPs) they usually look for two things: relevance, or how appropriate the content is for the given query, and trustworthiness, or how valuable and reputable the content is.

Domain authority is useful for gauging how reliable a website’s content is; the higher the domain authority for a site, the more likely its content will be to rank highly in SERPs.

Google doesn’t explicitly publish these scores, nor does it document how these scores are calculated. Instead, SEO experts (like the smart folks over at Moz) have come up with their own estimated formulations for domain authority. The scale usually runs from zero to 100, with zero being brand new sites with no authority and 100 being the most trustworthy sites on the web.

We’ll get more into how domain authority is calculated and how to increase domain authority later. But for now, understand that it takes into consideration a mixture of content quality, domain history and inbound link profiles.

Domain authority applies across your entire domain, so every page of your site shares the same domain authority rating.

You might also want to consider page authority, which is similarly calculated, except it applies at the page level. For example, you could have a high domain authority, but if one piece of content you published has a significantly higher page authority than your other pages, it’s going to perform comparatively better in organic search results than the rest of the pages on your site.

Related: Everything you need to know about domain names

Why is domain authority different from other SEO tactics?

The first SEO strategy most webmasters learn is how to optimize for strategically relevant keywords.

The basic idea here is to include important keywords within page metadata, and notably, in the body of your content, to increase their likelihood of ranking for queries with similar wording.

Website owners who follow this strategy while ignoring other SEO tactics are often perplexed to learn that their search rankings aren’t improving as expected.

Focusing on domain authority is distinct from keyword-based tactics for several important reasons:

The authority factor

Remember, search engines need to see both relevance and authority to regard you highly for SERPs. As the name suggests, improving your domain authority is critical for improving the “authority” side of the equation.

Without it, even the best keyword optimization strategies are going to fall short because search engines will have no way to measure whether or not that content is trustworthy.

Sitewide application

Your domain authority applies to your entire site, including any subdomains you have and any and all pages of content you produce.

This makes any investment in your domain authority valuable for every other SEO tactic you execute.

It’s a rising tide that lifts all boats.

Growth and sustainability

Domain authority is hard to increase because it depends on so many factors, but once you start increasing it, it’s relatively easy to preserve that momentum. Over time, your domain authority will get higher and higher, boosting your relevance almost permanently.

Short of following black-hat SEO tactics, there are few ways to decrease your domain authority, so you’ll likely continue reaping the benefits of your domain authority investments for years to come.

Related: What is a meta description?

Why is measuring domain authority useful?

With the help of a domain authority checker, you can numerically measure your site’s domain authority, on a scale of 0 to 100. Why is this useful?

For starters, it’s a good indicator of the overall health of your SEO campaign. Your domain authority can increase thanks to better on-site content, more inbound links and other factors, so if you see your DA ticking upward, it’s a good sign you’re doing things right.

Additionally, it’s a useful measure for competitive analysis. Understanding that your top competitor has a higher domain authority than you can help you identify some of the specific tactics that set them apart. It can also help you determine when it’s worth fighting a competitor for a contentious keyword phrase, and when it might be wiser to back off.

Related: How to find inspiration from your competitors (without stealing their ideas)

How is domain authority scored?

Now let’s investigate how domain authority is scored.

Inbound link profile

There are several minor factors that play into your domain authority, but the biggest factor is your inbound link profile. Google’s search algorithm relies on a system known as PageRank, which basically calculates a site’s trustworthiness based on the number and quality of links pointing to it.

A site with many links pointing to it will typically be seen as more authoritative than one with few links pointing to it.

However, there are many other factors to consider. For example, links from more trustworthy sources pass more authority than links from new or untrustworthy ones, and it’s better to have links from many different sources than it is to have many links all from one source.

Accordingly, link building is one of the best ways to increase domain authority.

Related: How to get backlinks to a small business website

Other factors include:

Site structure

Sites that are properly structured for search engines to crawl are automatically going to be considered a higher domain authority than sites that aren’t. If Google can’t even see your site, you won’t have an authority score at all.

On-site content quality

Google has built-in algorithms that are able to calculate content quality, or at least estimate it. Using evaluations like natural language recognition, Google can reward sites with better-written material.

Domain history

Older domains tend to carry more authority than newer ones. This isn’t a make-or-break factor, so don’t let it discourage you if you’re starting a new site from scratch.

Note that domain authority is best used as a comparative tool, and might not have a one-to-one relationship with search rankings — in other words, a site with a higher domain authority won’t universally outrank a site with a lower one.

Domain authority checker tools

So how can you measure your domain authority? The best way is with an online domain authority checker. These are some of the best tools available:

Moz’s Link Explorer

Moz is the company that defined domain authority initially and set the zero to 100 scale. You can use its Link Explorer tool to calculate the DA of practically any domain and analyze the links pointing to it at the same time. You’ll be limited in how many queries you make unless you pay for full access.

Moz is the company that defined domain authority initially and set the zero to 100 scale. You can use its Link Explorer tool to calculate the DA of practically any domain and analyze the links pointing to it at the same time. You’ll be limited in how many queries you make unless you pay for full access.

Small SEO Tools

Small SEO Tools has a more basic domain authority checker, but it should give you all the information you need within seconds. All you have to do is plug in the URL you want to check, and you’ll see its DA, page authority and more.

Small SEO Tools has a more basic domain authority checker, but it should give you all the information you need within seconds. All you have to do is plug in the URL you want to check, and you’ll see its DA, page authority and more.

SEMRush

SEMRush is a paid search analytics tool, but you can make 10 free queries when you create an account. With it, you’ll get access to measurements like domain authority, page authority and SEO-related data like search rankings and organic traffic.

SEMRush is a paid search analytics tool, but you can make 10 free queries when you create an account. With it, you’ll get access to measurements like domain authority, page authority and SEO-related data like search rankings and organic traffic.

Editor’s note: Do you need some expert help with search engine optimization (SEO)? Check out GoDaddy’s SEO Services today! After a free consultation, we’ll work with your business to help you rank higher and earn more traffic.

How can you increase domain authority?

Now let’s get into how to increase your domain authority. Let’s assume you’ve structured your site in a crawlable way, and that you have no real control over the length of time your domain has been active.

1. Produce high-quality content

Your first step is to produce high-quality content for your blog on a regular basis.

High-quality content is not only going to directly increase your domain authority, but it’s also going to serve as an anchor point for the links you build for your domain.

High-quality content is free of spelling and grammatical errors, has a diverse vocabulary, natural speech patterns (i.e., no keyword stuffing), and links to other valuable sources.

It’s also important to publish new content regularly since Google disproportionately favors new content. Aim to produce at least one high-quality post per week, if not more, but remember to prioritize quality over quantity.

Related: Editorial calendar — The content, keyword and SEO connection

Earn inbound links

![Chain Links Represent Inbound Links for Domain Authority]](https://blogcdn1.secureserver.net/wp-content/uploads/chain-links-represent-inbound-links-for-domain-authority.jpg)

Your next step is to earn more inbound links for your site.

This is the best way to increase your domain authority, but it’s also the trickiest. That’s because Google is acutely aware of the possibility that webmasters are building fraudulent or manipulative links for the sole purpose of increasing their domain authority and search rankings.

Accordingly, your link building strategies need to be focused on providing value to web users while simultaneously pointing to your site.

The safest approach is to popularize your best content in the hopes that other writers will see it and cite it in their own work.

For example, you can distribute your content on social media, complete with original research and statistics that other content producers will link to.

However, it’s often more reliable to build links on your own. If you want those links to be relevant and valuable to web users, the best way to do this is through guest posting with external publishers. The basic idea is to write an article that the publisher (and their audience) will find valuable, and find a way to relevantly link to your on-site content in the body of that article. For example, you might cite your own original research or link to a guide you’ve written for further reading.

Related: How to start guest posting for your business

Link building strategies

Link building is a complex strategy that takes years to truly master, but these introductory tips can help you if you’re just getting started:

Prioritize content quality. New link builders often get carried away trying to link to their work no matter what, but it’s vital to prioritize the quality of your content above everything else. If your articles seem slapped-together or poorly researched, you aren’t going to get featured.

Always link in a relevant, valuable way. Your link can’t be shoehorned in, or it’s going to be removed or look spammy. When linking to your on-site content, always make sure it’s done in a way that’s valuable to readers and relevant to the topic at hand.

Keep seeking new publishers. Subsequent links on the same publisher will yield diminishing returns, so always keep seeking visibility on new publishers.

Point to many different articles. Keep your page authority in mind, and try to build links to a variety of internal pages.

Work toward obtaining links from high DA publishers. The higher the domain authority of the referring domain, the more authority you’ll gain from a link built on it. High DA sites often have high standards for the content they publish, so consider starting with low DA sites and gradually working your way up.

Avoid link schemes. Many sites will promise to increase your domain authority quickly, or build you lots of links in a short period of time. These are usually link schemes, and they’re going to do more harm than good. If it sounds too good to be true, it probably is.

Start building domain authority

It’s practically impossible to rank higher in search engines unless you spend time focusing on improving your domain authority — and there are plenty of secondary benefits to authority-boosting strategies as well.

Rely on link building and content development to be the pillars of your strategy, and keep an eye on your competitors so you continue to improve.

This article includes content originally published on the GoDaddy blog by Christopher Ambler.

The post What is domain authority and how can it enhance your search visibility? appeared first on GoDaddy Blog.

Read more: godaddy.com

In September 2018, I was just a few months into my journey of learning web development. As I'm sure is the case with many new developers, it was a big task for me to learn not only the basic skills required, but also keeping current with the fast-moving industry. Just as I was getting to the level where it felt as though I could build a simple website, I started to realize that it was only the first step.

Opening up a few HTML pages stored locally on my laptop felt like a million miles away from being able to say to someone, "Hey, check out my website, live on the actual internet!"

But I did it! And the best part is that it wasn't as scary, difficult or expensive as it first felt like it'd be.

It all started with me sending Chris an email, which he used to write an awesome article explaining everything in plain English.

At this point, I didn't have a fully coded website — just an idea for a basic site that I was using to teach myself as I went along. I used the ongoing progress of my site as a push to learn how to get a live website quicker. But I'm sure you could do the whole thing with an HTML document that just says "Hello, world!"

I built my site using Gatsby, a static site generator powered by React. Building a website with these tools in a modular way felt really natural to me. The concept of reusable parts is something I’m familiar with in my career as a physical product designer and mechanical design engineer. It means that you can build in stages, like Lego, brick-by-brick, until you eventually have a life-sized castle you can invite your friends to visit!

This isn't a guide. It's my personal experience in the process of getting a website from my laptop to being live on the internet. Hopefully it'll give you some hope that it's possible and achievable, even by someone who has no formal training in web development and who has only been doing it for 12 months!

Domain registrars

Before I ever bought a domain, it seemed like a pretty serious thing to do. Owning a domain means being responsible for it. People will go to that address and eventually see content that you've put there.

I don’t know if everyone has the same experience, but I spent weeks deciding on a domain name before going for it. It almost became an obsession of mine for a while, searching online for acronym generators to try and be clever, spending hours on dictionary.com trying to find synonyms that were cool. In the end, I settled for my name and what I do: joshlong.design. I still smile a little when I see my name in the address bar.

Since reading Chris' article, I've actually bought two domains from two different providers: a .com and a .design. I realize that I went against Chris' advice of consolidating domain names at a single registrar, but I needed to shop around a bit to get a good deal on my .design domain. I only own two domain names — and one of them I don't actually have any plans for just yet — so keeping on top of where I bought them isn't a task. In fact, I don't remember the last time I needed to login and manage the domain I use on a daily basis!

Buying a domain name was as simple as any other online shopping transaction. Nothing really huge or scary about it. I bought my .com through Namecheap, and my .design through Google Domains, and the process was pretty similar for both. All they needed was my name, address and payment details. Pretty standard stuff!

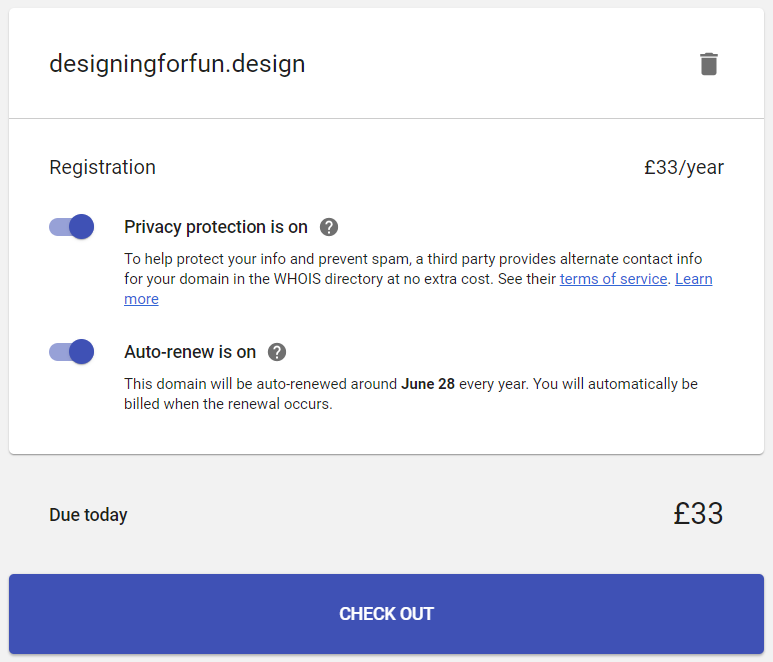

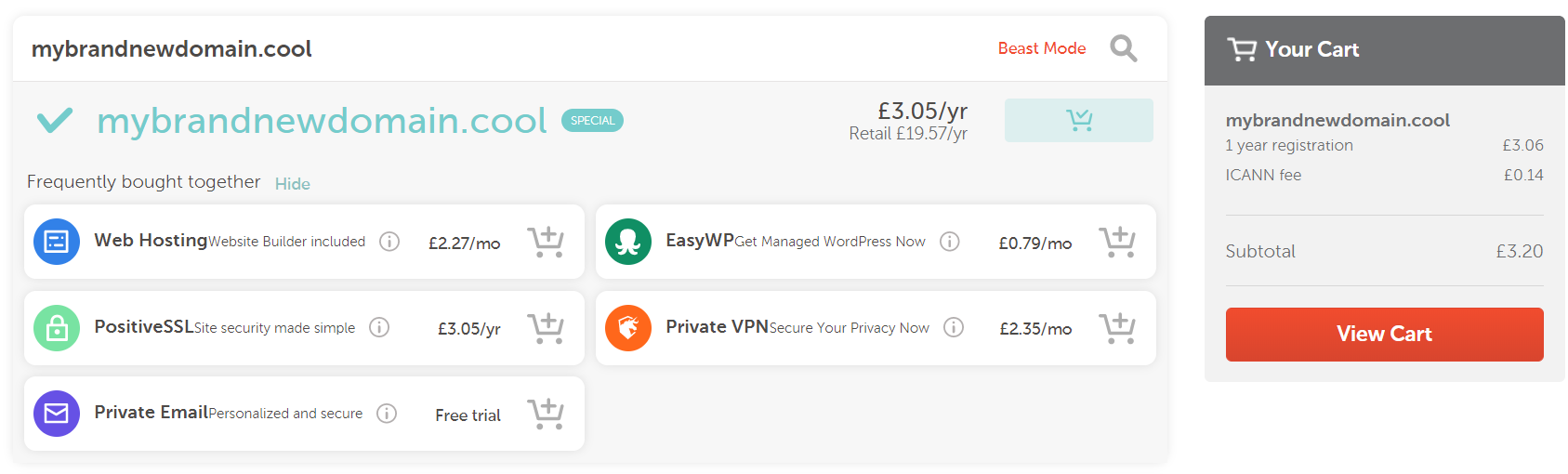

I don't remember Google trying to sell me a load of extra packages. They seemed happy with me just buying a domain, though they did offer me free WHOIS protection which I snapped up because I didn’t want my contact details freely available for anyone who’s feeling nosey. However, as Chris warned might happen, the other registrar I went through tried really hard to sell me some extras like hosting, email, a VPN (whatever that is!) and SSL certificates.

Google Domains checkout is happy just to sell the domain name.

Google Domains checkout is happy just to sell the domain name.  Namecheap tries to sell you all the additional services they offer before getting to the checkout.

Namecheap tries to sell you all the additional services they offer before getting to the checkout.

I didn't go for any of those extras. I already had a hosting plan, and you can use an alias through Gmail to "fake" having a me@mycoolsite.com email address. I honestly have no idea why I'd need a VPN, and the hosting I was going to go for gave me a free SSL certificate through Let's Encrypt. So just the domain name, please!

Hosting

As Chris suggested it would be, choosing a host was a tad trickier than choosing and buying a domain name. But in the end, the web technology I used to build my site kind of guided me in a particular direction.

My site is built with Gatsby, which means it outputs straight-up static assets, basically as HTML and JavaScript files. That means that I didn't need a host that offered a server (in my most super smart authoritative voice), especially for WordPress with a MySQL database and Apache server, 6 cores @ 3.6 Ghz, 4GB RAM, 5TB bandwidth, 5 IP Addresses and 500GB SSD Storage, etc.

All that jargon goes straight over my head. All I wanted to do was upload my files to the internet and go to my domain to see them all compiled and shiny. Should be easy, right?

Well it turns out that it actually was that easy. As there's been so much hype around it recently, I thought I'd take a look at Netlify.

Netlify is recommended by Gatsby. They have really good documentation, and for my uses I felt as though I could comfortably stay within the free tier that they offer. In fact, at the moment I'm using 0.08% a month of the total bandwidth the free tier offers. Winning! Although maybe that means I’m not doing enough to get people to my site...

A quick aside about GitHub: I'm no expert at it and I don't really know any of the etiquette it entails. All I did was sign up, create a new repository and follow the instructions that they give you. After that, every time I made a change to my site, I used the buttons in my code editor (VS Code) to commit and push my changes. It works, but I have no idea if it's the correct or best practice way of doing it! I'm starting now, though, to understand how to use Git through the command line. I had no idea at all how to do it when I started, but I still muddled through it — and you can too!

Back to Netlify.

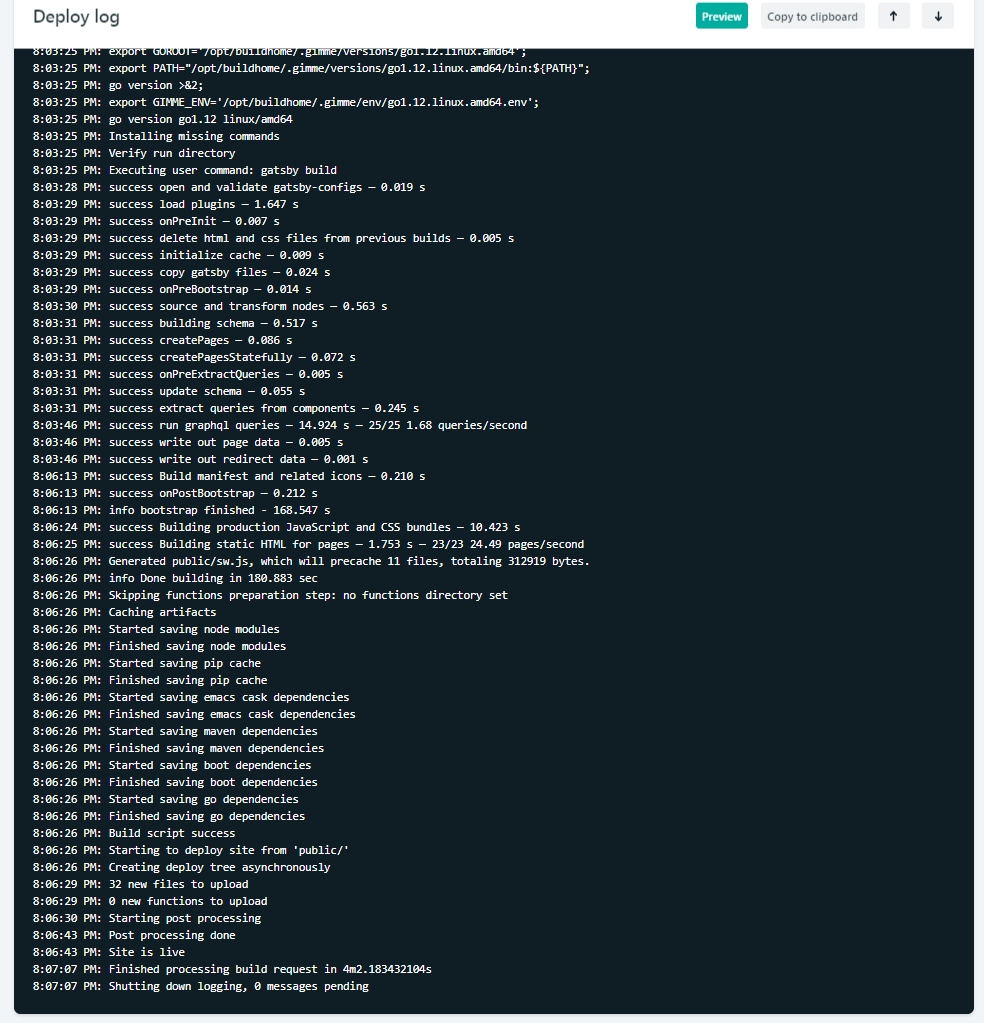

I signed up for an account (no credit card details required) and added a new site to Netlify by telling it about the GitHub repository where it was stored. When you’ve connected your repository, you can watch Netlify doing its thing deploying your site.

Part of the Netlify’s deploy process is that it shows your website going live in real time. That’s useful for debugging if something goes wrong, or just to watch and get excited like an impatient puppy waiting for a biscuit.

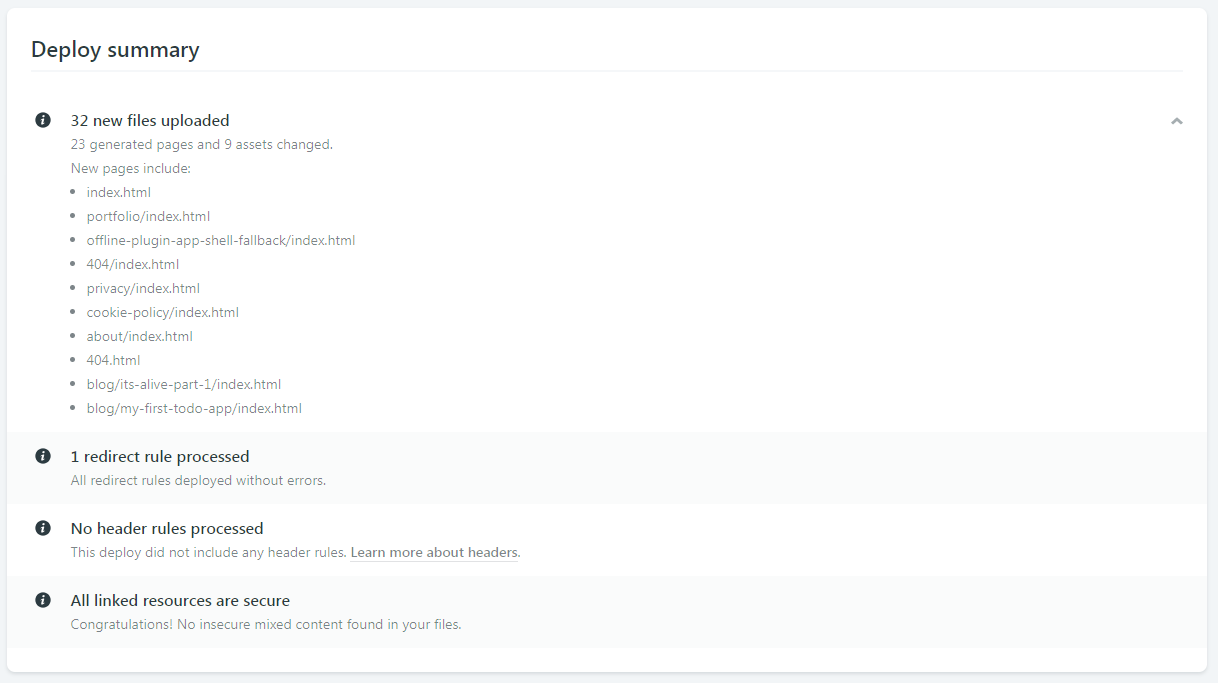

Part of the Netlify’s deploy process is that it shows your website going live in real time. That’s useful for debugging if something goes wrong, or just to watch and get excited like an impatient puppy waiting for a biscuit.  You also get a deploy summary to quickly see what files were uploaded during deployment.

You also get a deploy summary to quickly see what files were uploaded during deployment.

After my site was deployed to the randomly generated URL Netlify gives you, I followed their instructions for adding a domain I had registered elsewhere. They make it so easy!

I assume the instructions will be different for different hosts, but basically, Netlify gave me some server addresses which I then had to go back to my domain registrar to enter them in. These addresses are referred to as nameservers, so look out for that word!

Netlify gives you your nameserver addresses and super easy to understand documentation to set them up with your domain registrar

Netlify gives you your nameserver addresses and super easy to understand documentation to set them up with your domain registrar

Once I entered my Netlify nameservers into Google Domains, Google knew where to look to send people who type my domain name into their browser’s address bar. All I had to do after that was wait for some internet magics to happen in the background. That took around three hours for me but can take anywhere from 10 minutes to 24 hours from what I hear.

After that was done, I could type my shiny new domain name into the address bar and — just like that — I'm looking at my own site, hosted live on the internet!

Content Management Systems

The world of Content Management Systems (CMS) is vast, and confusing, but it can also be completely irrelevant to you if you want it to be. I felt so liberated when I realized you don't have to worry about it. It was one less thing in my list of things to do.

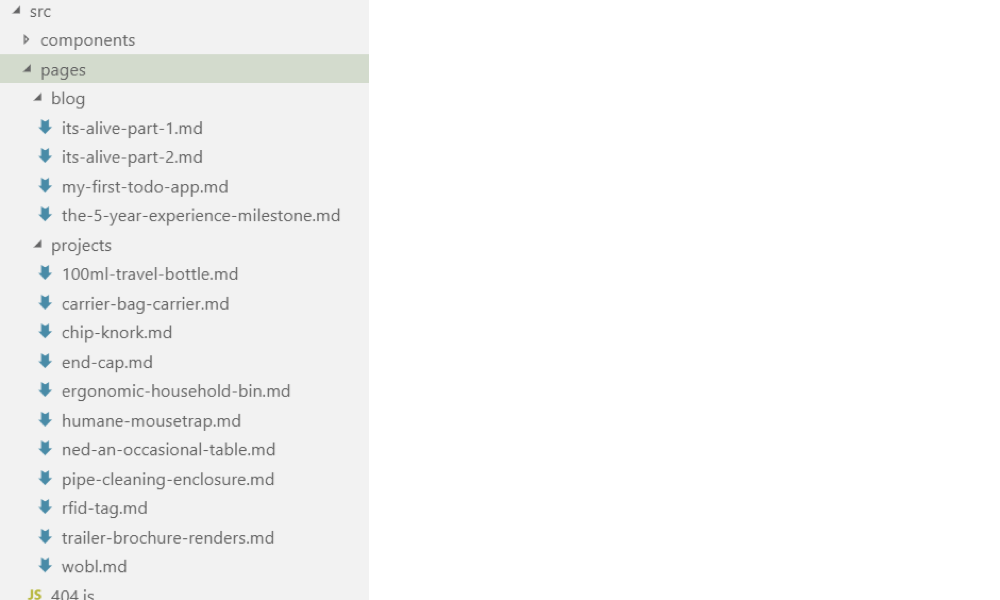

My Gatsby site posts and pages (my content) was just a directory of markdown files and my CMS was my text editor. Chris and Dave talked about the idea of this in a recent episode of ShopTalk Show.

My website content is managed right in my text editor, VS Code.

My website content is managed right in my text editor, VS Code.

Because I wanted to have a standard structure for different types of posts and pages, I eventually started using NetlifyCMS which is an open-source CMS which can be included in your site real fast. (Chris also did a video recently about NetlifyCMS for his confer-reference site... see what I did there?!) Now I can create blog posts and drafts from anywhere in the world, straight from my website, as long as I have an internet connection!

The same content managed through NetlifyCMS, which offers a great UI and GitHub integration Asset Hosting (CDNs)

The same content managed through NetlifyCMS, which offers a great UI and GitHub integration Asset Hosting (CDNs)

A Content Delivery Network (CDN), as Chris explained in his article, is basically somewhere on the internet where you store the files you need for your website to run, HTML, CSS, images, etc. When your website needs them, it goes to the CDN and grabs the files for your site to use.

From what I've read, it's good practice to use a CDN, and because of the hosting decision I made, it's not something I have to worry about - it's included by Netlify as standard, for free!

Netlify has it's own CDN where all of the files for your website are stored. When someone goes to your website, Netlify goes to its CDN and grabs the files. It's amazingly quick, and makes your site feel so much smoother to navigate.

It's a long journey, but you can do it!

There was a point, before I set off on the journey of getting my website live, where I tried to convince myself that it's fine to just have local websites, as my career isn’t in web development. The reason for that was because the path felt like it would be difficult, long and expensive.

In fact, it was none of those things! You could get a website live on the internet for £0.99 (~$1.25 for you Americans) or less if you find a deal on a domain name. The domain name was my only expense because for the path I took for hosting, asset management and content management.

At a super basic level, the path looks like this..

Code > Buy Domain > Find/Buy Hosting > Update Nameservers > Upload Code > Live!

If you happen to use the same vendor to buy your domain name and your hosting, you can skip the nameserver step. (Netlify sells domains too!)

It's definitely possible for anyone to get their website live on the internet. There's a process that you need to follow, but if you take your time, it can be relatively straightforward. It's a really wonderful feeling, getting a thing you built in front of people, and it's honestly something that I thought I'd never be able to do. But it's certainly within everyone's reach!

Something I've come to really admire over this process (and thousands of Google searches) is the willingness of everyone in the web community to collaborate and help, accepting me and my questions as I tried to learn what I was doing. It's something that I wish was more common in my own industry.

I'd love to hear other people's experiences getting their first website live. What were your pitfalls and triumphs? Was it as scary as it first seemed?

The post A Beginner’s Journey to Launching a Website appeared first on CSS-Tricks.

Read more: css-tricks.com

So the dust has settled on the .INC domain launch, and a whole bunch of ‘Incorporated’ businesses across the U.S. now have pretty impressive new .INC web addresses. And they certainly should be impressive too, because .INC’s certainly don’t come cheap.

That’s why this felt like the perfect time to examine why the price of .INC might be considered high. What made it so expensive in comparison to most other top-level domains (TLDs)? Why are some special? Why aren’t all domain extensions created equal?

Who Sets The Price?

First, let’s back up and take a look at who actually sets the prices for domain names in general…

You purchase domain names through a ‘registrar’ like Namecheap, but registrars get their TLDs supplied by ‘registries’. These are the ones who actually control each TLD. So just like a standard store or shop, the registry sets the price and the registrar (like Namecheap) adds its markup.

So far so standard. And while it’s important to understand the background context, it doesn’t explain why registries set the wholesale prices of some TLDs so high.

What Are The Other Factors?

It’s certainly not down to historical value. For example, we all know that .COM is still the king of TLDs. It’s been around so long it now seems to go hand-in-hand with the internet itself. In fact, the most expensive domain names out there are all .COMs:

LasVegas.com – $90 millionPrivateJet.com – $30.18 millionVoice.com – $30 millionInternet.com – $18 million360.com – $17 million

But we’re not talking about full domain names, we’re only talking about top-level domain extensions. So unless you’re trying to buy a popular .COM domain name that someone else already owns, the price of the .COM TLD itself can be comparatively cheap. If you go to the right place.

Is It Because It’s New?

It may seem like the price is high because .INC is the freshest thing on the menu. While that is almost certainly a factor to consider, many new TLDs are released every year, and their prices still don’t come close to .INC—like .DEV, which was also released this year, for example.

Mind you, the .INC domain certainly had two things in common with .DEV:

It was a brand new releaseIt had a relatively niche customer base

And it’s the customer base that makes the difference here. While .DEV’s core customer base is developers, .INC’s customer base is corporate America. It doesn’t take a genius to figure out that’s quite a difference in business and budget size. The registrars know these type of organizations have deeper pockets. They know they can and will pay more. But, there’s still more to it than that. It’s not just about what people can afford to pay.

Paying For Brand Equity

The Inc. abbreviation is recognized and renowned around the world. It’s niche, and yet globally respected all at the same time. It shows potential customers and clients that you are incorporated in the U.S. and so your business is the real deal. It’s a sign of quality and stability. It conjures up images of skyscrapers and sharp suits. It screams “I’M IN BUSINESS, AND I MEAN BUSINESS!” And that’s all before anyone’s even set eyes on your actual website. Not bad for three letters and a dot.

Pay More, Get More

Just like shares in an oil company will probably be worth more than shares in a toy company, a similar principle applies with TLDs like .INC. You’re buying more than a new domain extension. You’re buying extra recognition and brand equity, and ultimately more high-value customers, which means more overall business. It’s not a purchase, it’s an investment. It’s about both instant gain and long term value.

This TLD that can either reflect your status or help propel you towards the big leagues. That’s the key difference. It’s not about what .INC is. It’s about what it represents and offers.

So, next time you feel like gasping “How much!?!” when you see the price of a TLD, ask yourself what it represents in terms of strategic and business value. If you have the right sort of business, would you really sacrifice massive brand equity and potential future business just to save in the short term? Take a look at .INC for yourselves and find out.

The post Why Domain Extensions Aren’t All Created Equal appeared first on Namecheap Blog.

Read more: namecheap.com

Cyber threats are having a significant impact on businesses — that much is clear. Budget and resources are being dedicated to securing infrastructure and applications, and educating staff on the dangers of phishing, malware and social engineering. For marketers, cyber security is quickly encroaching on brand protection as a whole, and rightly so. The lines between the two areas are blurring and in the future it is conceivable that the two disciplines are far more integrated than they are now.

But what about domains? How does domain security factor into wider online brand protection initiatives? While domain registration, renewal and management are an integral part of online brand protection, does security gain the same attention?

Regardless of the current approach, marketers should be focused on this aspect, especially seeing as the threat is increasing in the domain name system (DNS) space. Historically this wasn’t a target for cyber criminals or hackers, but as they become bolder and more sophisticated, nothing is off limits.

What’s the damage?

In an internet-enabled world, any issues with a brand’s website can have potentially devastating consequences, from loss of sales and revenue, to diminished customer trust. So how can hackers cause damage and disruption by launching a domain attack? Firstly, they can take your website offline. No website means no customers and no sales. Secondly, they can redirect traffic from your website to another one that may look like yours. In this way they can capture customer data, such as personal information or payment card details, or they can use the misdirection to sell counterfeit goods. Lastly, they could also possibly hack into your DNS account and transfer your domain away from your organisation.

Domain protection

Given the importance of domains, what should brands do to secure them and mitigate the risk?

Work with the right corporate registrar

Choosing the right corporate registrar is the first step in a domain security plan. The right register will have hardened security practices in place and an excellent understanding of the landscape, the threats and the ways to mitigate them. Such a registrar will also have specialised security features for preventing, detecting and responding to attacks against any domains, including:

Restricting access to a portal via an IP address Sending notifications on any name changes Avoiding automated emails as a primary means of communication Keeping activity logs to track all domain name updates Maintaining strong password management to force password changes Offering multiple levels of access Consolidate your portfolio

The best way of securing your domains is to know which ones you own — maintain careful records of all domain names across all your brands, offices and locations. Ideally, this should be a centralised, global view to ensure you’re always looking at the whole domain picture.

Monitor critical domains

It’s also important to constantly monitor the domains that are core to your brand. Again, working with the right registrar can help here, as they can monitor for differences between the nameservers stored at the registry compared to the nameservers stored in their databases. A mismatch could be the first sign someone has broken into a registry system and made an unauthorised update.

Use two-factor authentication as standard

When accessing a domain management portal or DNS management portal, use two-factor authentication because it provides an extra layer of security that requires not only a password and username, but also something that only the user can give, such as a one-time password via a physical token.

Use domain locking

To mitigate the threat of domain name hijacking, you should ensure your domains are locked. This means they can’t be transferred. Taking this a step further, you should also implement registrar locking, which is an elevated locking mechanism that freezes all domain configurations until the registrar unlocks them upon completion of a customer-specified security protocol. This should be applied to your most mission-critical domains such as transactional sites, email systems, intranets and site-supporting applications.

Moving forward

The threat that cyber criminals and hackers pose to brands shows no sign of abating. While the consequences of an attack could be severe for an organisation, there are ways to mitigate the risk, especially when it comes to domain security. Importantly, domain security needs to be considered as part of a much wider online brand protection strategy that also takes the cyber threat into account. As a result, working with the right partners and having the right processes in place can position your organisation to effectively deal with the threat.

Interested in hearing leading global brands discuss subjects like this in person?

Interested in hearing leading global brands discuss subjects like this in person?

Find out more about Digital Marketing World Forum (#DMWF) Europe, London, North America, and Singapore.

Read more: marketingtechnews.net

Every great website needs a snappy, memorable domain name. Coming up with something new is a serious challenge, but once inspiration strikes, you'll need to register that name with a domain name registrar before you can use it online.

Registration isn't difficult, but first you must choose from the hundreds of companies competing for your business, and there are several things for you to consider before signing the virtual dotted line.

We’ve also rounded up the best overall web hosting services How to choose the perfect domain registrar Pricing structures can be complicated. A low headline figure could become expensive on renewal, for instance. Prices vary between domain extensions, too, so a registrar that offers great value for a .com domain might give you a poor deal on when it comes to .org.There may be extra costs for tasks like transferring your domain to another registrar, too. Read the small print before you sign up.Look for any bundled or optional extras. A Whois privacy service prevents your address, phone number and email address appearing as public contact details for the domain, something which could otherwise get you a significant amount of spam email and phone calls. We've seen this cost as much as $11.20 a year, but several registrars provide it for free.Many domain registrars offer hosting as an extra, but keep in mind that web hosting companies can also register domains. If you have an idea of which web host you'd like to use, check the details of its plans: you may be able to register a domain for free when you buy hosting, and that's often the cheapest option.Finally, take a look at the support a registrar offers. You may never need any help at all, but if anything critical crops up – maybe an issue which might cause a problem with renewal – it's important that your provider is on hand to ably assist. Balancing all these priorities can be tricky, so that's why we've created this list of top domain registrars to help point you in the right direction.

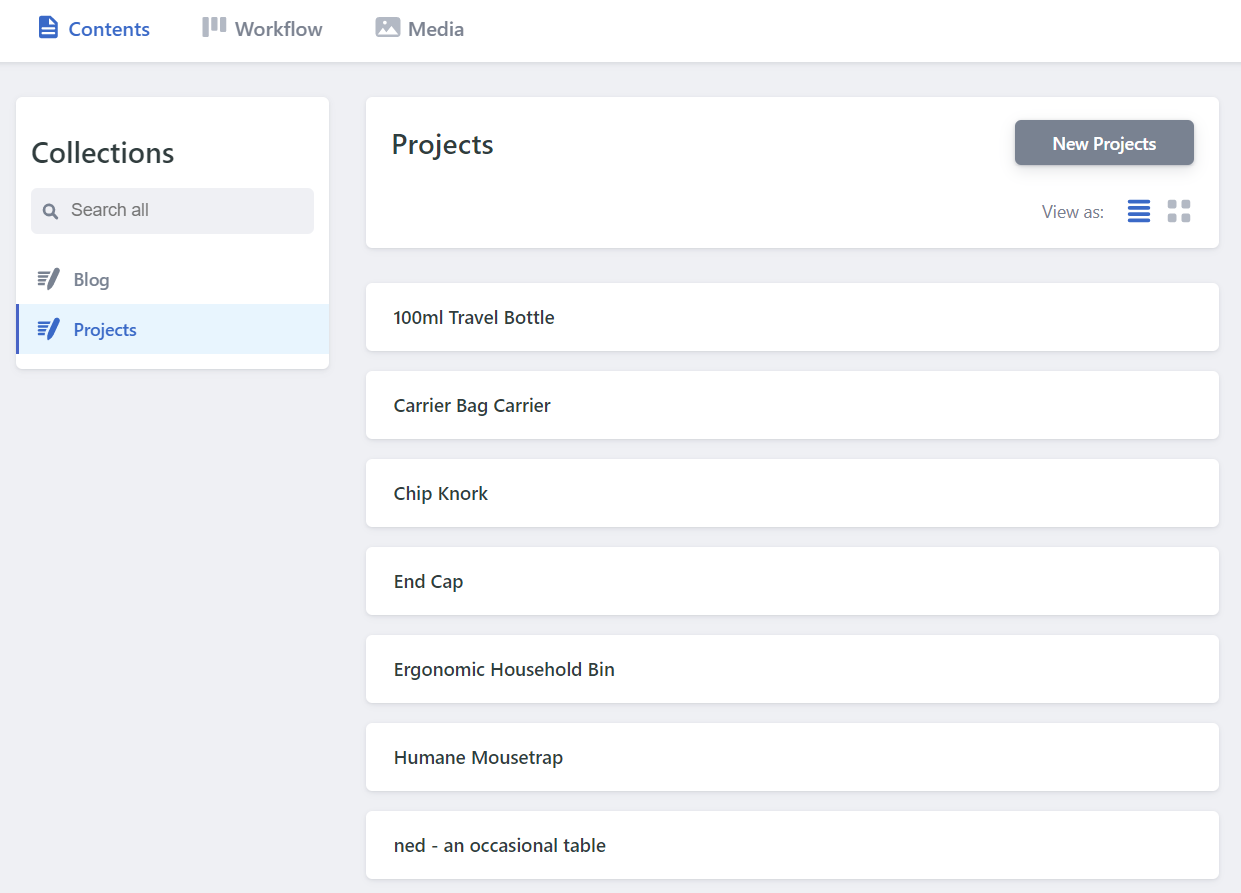

With a name like Domain.com, the EIG-owned brand, means business, focusing primarily on small and medium businesses. It offers most popular top level domains and over 25 country code top level domains and also sells premium domains as a broker.

With nearly two decades of online presence, the company - which is one of the world’s biggest domain name registrars - expanded in web hosting and now ranges a number of products including a website builder, a full design service and web hosting.

Domain.com prices tend to be average but we have managed to blag a 25% discount off almost everything in your cart*. Non-premium TLD (.Club, .Me, .Website etc) start from $2.99 for the first year ($2.24 with our code). In line with the rest of the industry, they rise significantly after the second year).

You need to pay for privacy protection, a reasonable $8.99, plus you can add email, web hosting, SSL certificates and malware protection, none of which is compulsory. You can stick with its basic website builder which is free with every domain: you get a drag and drop website builder, tons of mobile-friendly templates, up to six pages, SEO tools, Paypal integration and even access to stock image library.

Support is more than adequate with 24/7 chat, email and phone support. Domain.com may not have the cheapest prices but it provides with a very balanced offering.

*All renewals after the initial discounted period will be charged at the then current standard list price for the selected period. Coupon is not valid with sunrise registrations, landrush registrations, EAP registrations, pre-registrations, premium registrations, renewals, transfers, custom website design, other coupons, or special pricing.

Web giant GoDaddy is the world's biggest domain registrar, currently managing more than 75 million domains for 17 million customers around the globe.

The company is well-known for its low headline prices, and it's the same story here, with .uk and .co.uk domains available for $0.99 in year one. On the other hand .com and .org are less impressive (though still apparently cheap) starting at $12.17. Beware, though: these aren't the bargains they initially seem.

The first catch is that GoDaddy's starting prices only apply if you pay for two years upfront, and the second year is significantly more expensive (.com rises to $18.17, .uk and .co.uk domains rise to $12, .org and .mobi are ridiculously high, $21.17 for .org and $26.17 for .mobi - at the moment, first year for .mobi is $7.17, due to an offer).

The second problem is that there are no bundled extras, so adding something like Whois privacy – a valuable service often included for free with other providers – costs $8 a month for year one, and $10 on renewal.

There's clearly much better value to be had elsewhere, but GoDaddy may still appeal to web beginners looking for a bundled hosting and domain registration deal. The company has an array of products covering every possible requirement, with telephone support if you need it, and buying your domain and hosting from the same provider will make life a little easier.

Just keep in mind that other providers can also combine hosting and domain registration, and GoDaddy may not provide the best package for you. Check out our various hosting guides for possible alternatives.

You can sign up for GoDaddy domain registration here

Hover is a popular domain name registrar owned by Tucows, which also operates eNom and the domain reselling platform OpenSRS.

Hover's website is clear and straightforward. A domain pricing page allows for checking registration costs before you start, or you can use the search box to immediately locate your preferred TLD (top-level domain).

By default the results page displays every domain you can register and their prices, giving you a lot to scroll through and read. But a handy sidebar allows filtering domains by categories including Personal, Businesses, Audio and Video, Food and Drink, and more. It's a neat touch which could help you spot an appealing domain that you otherwise might have missed.

Prices are very reasonable, with .com domains costing $12.99 for year one, .co.uk priced at $10.99, .org costing $13.99 and .mobi reaching $15.99. Shop around and you'll find slightly lower prices elsewhere, but Hover generally provides good value.

There's a welcome bonus in Whois Privacy, which comes free for as long as the domain is managed by Hover.

The company keeps upselling to a minimum, even in the final shopping cart stage. You're simply offered three email-related extras: email forwarding at $5 a year, a 10GB email account for $20, or you can opt for a 1TB inbox, file sharing, a calendar and more, for an annual $29.

If you have any questions, support is available via email and chat, although it's not 24/7. Working hours are 8am to 8pm (Eastern Time) Monday to Friday, and 12pm to 5pm at the weekend.

You can sign up for Hover domain registration here

Most domain name registrars offer a simple identikit service with little to separate them from the competition, but Dynadot is an interesting exception which has some unusual advantages.

This starts right at the beginning, with your initial search. You can use the website much like any other – type your preferred domain, press Enter, read the results – but you also get Bulk and IDN (Internationalized Domain Name) search tools, and advanced options allow defining which domain extensions to include in your searches, as well as setting those as defaults for all future searches.

These searches can optionally return results from domain auctions, Dynadot's Marketplace (where other customers sell domains they no longer need) and other sources. There's also a Backorder option to try and grab a domain that isn't currently available, if it's not renewed.

Prices are on the low side, with Dynadot offering both special deals on some extensions and good value at renewal. .com sites are $7.99 initially, $8.99 on renewal. If you’re after a .co.uk domain, that’ll set you back $6.95, with .org costing $10.99, and .mobi domains are $4.25 initially, $13.99 on renewal.

That's just the start: Dynadot also piles on the free extras. A Website Builder allows you to build and host a simple one-page responsive website. There's free domain forwarding if you'd like to redirect visitors somewhere else. DNS support allows creating 50 subdomain records, 10 email addresses, and 5 each of MX and TXT records. There's even a Grace Deletion list which allows returning a domain if you change your mind.

This requires a small fee and won't always be allowed (the details on how it works are here), but it's still a welcome extra you'll rarely find with other registrars.

Dynadot's support wasn't always as impressive, with live chat being offline when we checked. But the website does have a publicly available forum, allowing anyone to browse common questions and see how happy (or otherwise) Dynadot's customers might be.

You can sign up for Dynadot domain registration here

Founded in 2000, Namecheap is a popular domain name registrar and web host which now manages more than five million domains.

Namecheap's excellent website allows searching for individual domains, or in batches of up to 50.

If the domain is taken, you can view the Whois record or offer to buy the domain (via DomainAgents) from the current user.

If the domain is available, results are displayed across four tabs: Popular, New, Discounted and International. This is a neat approach which makes it easier to browse the list and find what you need.

Prices are generally very good at $8.88 (£6.8) for .com domains - $12.98 on renewal, $7.58(£5.8) for .co.uk - $9.58 on renewal, $12.98 (£10) for .org - $14.98 on renewal, and $16.88 (£13) for .mobi (at the moment, you can get .mobi for $2.88 for the first year). There are some special deals available, and Namecheap has an Agent 88 set of domains which are almost always available at $0.48 (£0.35) for the first year (these usually include the following: .site .website .space .pw .press .host .tech .online and .fun – but there may be others as well).

That would be good value all on its own, but Namecheap doesn’t stop there: you get WhoisGuard domain privacy thrown in for free.

Namecheap's billing is straightforward and honest, with current and renewal prices clearly described in your Namecheap shopping cart, and Auto-Renew turned off. But if there's something you don't understand, helpful FAQ pages and live chat are just a click or two away.

You can sign up for Namecheap domain registration here

Shopping around for a domain registrar can involve a lot of hassle as you research companies you've never heard of, try to separate genuine bargains from marketing tricks, and browse the small print looking for hidden catches. With potential savings only amounting to a few pounds or dollars a year, at best, you might prefer to simply sign up with a big-name provider that you know will give you a reasonable service, even if it does cost a fraction more.

Enter Google Domains, Google's lightweight domain registration arm, a straightforward provider that puts speed and simplicity at the top of its priority list.

Google Domains doesn't confuse you with endless sales, or 'special' deals that turn out to be not so special after all. Upselling is kept to a minimum. Instead, it's all about making the purchase process as easy as any other online shopping site: search, click, and check out.

The difference is obvious from the moment you reach the site. There are no animated ads at the top of the page, no 'Sale!' banners, no low headline prices: just a search box where you enter a single domain.

The results page is equally straightforward, with prices listed for nine common top-level domains, and an All Endings tab listing every option in alphabetical order (domain.academy, domain.bargains, domain.camera).

One potential problem is that Google Domains doesn't support all the domain extensions you'll get elsewhere, and this includes some quite common examples (.mobi, .tv). If you think you might ever want to buy something beyond the most popular extensions, it’s a good idea to check that your likely choices are available before you buy.

Prices are standardized to whole numbers, so for example .com, .co.uk and .org domains are all priced at $12. That's a little above average overall, but better than some, especially as Google Domains throws in free Whois privacy for as long as you're registered. That's a valuable extra which could cost $2.80 to $11.20 a year elsewhere.

If you do have any questions, a Help link displays articles on common problems. If that's not enough, the Contact Us page enables talking to a support agent by email, live chat or telephone (Google calls you), the highest level of domain registrar support we've seen anywhere.

You can sign up for Google Domains domain registration here Check out the best website hosting services

Read more: techradar.com

Often, all it takes is a little money to get the ball rolling for a young (or new) company. But what options are out there to acquire the necessary small business funding that a startup needs to put things in motion and actually begin growing?

Fully understanding the choices available — as well as the process of how to raise capital — are the factors that set many successful young businesses apart from their counterparts.

And while these startup funding options aren’t always intuitive, it only takes a bit of effort to absorb and understand them.

Small business funding guide

This comprehensive guide was created to act as that bit of effort. It aims to help entrepreneurs and small business owners get up to speed on myriad funding options for new and fledgling ventures.

Before we dive into the specific small business funding options, though, we’re going to take a close look at 5 recommended preliminary steps to take prior to exerting energy raising capital (because everyone has to start from somewhere).

Solidify your business plan. Know your numbers. Begin to build business credit. Establish or strengthen your business’s online presence. Do your research.

Then, we’ll take a deep dive into 10 small business funding strategies (with pros and cons of each) to help you better understand the choices at your disposal, so you can get the financing needed to succeed.

Bootstrapping and personal loans. Crowdfunding. Small business financing via angel investment. Equity fundraising. SBA loans. Other types of small business and startup loans. Small business grants. Business credit cards. Business credit lines. Equipment financing.

We’ll round out this guide with some additional startup and small business funding options to consider.

Ready? Let’s make it rain!

Editor’s note: This content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

Preparing to raise capital: 5 key steps

Raising money may feel like a daunting prospect if you’ve never done so before, but it’s a process that becomes less intimidating with a bit of preparation. Follow these five steps, and you’ll be in good shape when it comes time to meet with banks, investors and other potential contributors of small business funding.

Raising money may feel like a daunting prospect if you’ve never done so before, but it’s a process that becomes less intimidating with a bit of preparation. Follow these five steps, and you’ll be in good shape when it comes time to meet with banks, investors and other potential contributors of small business funding.

Solidify your business plan

If you’re an established business owner, you already understand the value of a fine-tuned business plan. But if you’re new to the entrepreneurial game or creating your first startup, it’s important to not overlook this key step in the small business funding process.

While viable business plans are comprised of numerous components, there are certain ones that are more critical than others. To create a business plan compelling enough to inspire startup funding, make sure you hash out these four key elements:

Element 1: Your value proposition

If you’re to have any hope of rounding up startup funding from investors, you need to have a well-thought-out value proposition. Understanding what your product or service brings to the table and being able to clearly explain this to others is essential.

If you’ve made it to this stage, you likely have a good idea of what this value element is. But have you explained it in writing before? Have you given anyone the “elevator speech” — the abridged version of what value you’re bringing to the market with your startup?

Related: What is an elevator pitch and why your business needs one

Element 2: Customer segments and relationships

Unless you’re pitching the next Google-type product, there’s a good chance you won’t be marketing your business to everyone (if you are, best of luck). Since you’ve already hashed out a sound value proposition, you should have a rough idea of what segment of the population might be interested in your product.

Do your research ahead of time, so you have some concrete, quantifiable data to share here.

Writing out your target demographic — including details like projected age range, gender, geographic location, education level, etc. — will help investors assess whether the potential is there or not for your business.

You also want to highlight how you plan to interact with this demographic, because this will (ideally) reflect a better understanding of your audience as well as your ability to connect with them.

Related: Why a target audience matters — and how to find yours

Element 3: Revenue streams

What’s your strategy for making money? It’s possible you have several in mind. For instance, maybe you intend on facilitating in-person sales, online credit card processing and even recurring ACH billing for a membership program you have in place.

Make your methods exceedingly clear in your plan.

Note that if you’re planning on opening a business considered risky by banks, you’ll need to work on opening a high-risk merchant account to ensure your revenue continues to actually keep streaming into your coffers.

It’s an encouraging sign to investors that you have your payment processing needs sorted out, and makes your ability to eventually pay them back much more apparent.

Related: 5 keys sections to include in your business plan’s financial projections

Element 4: Key activities and resources

Do you have any competitive advantages or ways of tapping into your industry’s market that set you apart from other businesses? Maybe you plan on simply doing something in a more efficient way than your competitors.

Such details will play a large role in how much your business plan resonates with interested listeners.

Also bring to light what resources you currently have to work with and how they can be wielded to help your customers. Things like human resources, additional capital, intellectual property — these details are valuable, and give your business plan some weight.

If you’re starting from scratch here, that’s OK, but having some type of resource to leverage makes your business instantly more compelling.

Lastly, it’s important to remember that while a business plan is crucial for small business financing and startup funding efforts, it holds more value than just that. Specifically, it acts as a guide that you can constantly turn to during those less stable early stages, plus it can help you in day-to-day operations.

Know your numbers

Some founders shy away from the financials, and put most of their energy into their product or service. While that enthusiasm and passion is ultimately what drives them to run their own business, none of it is possible without a solid understanding of the books.

Even if you decide to separate yourself a bit from the financial side and outsource your funding efforts, you should still learn how to read the statements and projections.

Potential lenders and/or investors will expect a clear explanation of your venture’s key metrics (e.g. gross margin, net income, cash requirements, monthly burn rate), use of proceeds, growth projections and, in the case of investors, their estimated ROI.

Numbers are the key to making a compelling case for your business.

Without them your chances of acquiring the small business funding necessary to thrive will greatly diminish.

Begin to build business credit

When you first enter the entrepreneurial world, you soon realize that personal credit can only get you so far as an owner, and that building business credit is imperative to your long-term success.

Taking time to build business credit during the early stages of your startup means that you’re setting yourself up to get approved for the loans needed to expand later.

And while this step is a gradual one, over time it will solidify your financial standing with banks and investors, as well as establish your business as a trustworthy organization to work with.

Plus, as you build business credit your interest rate for loans will gradually decrease. By understanding how business credit works, you can put your business in a better position financially.

The four credit bureaus for businesses

There are four credit bureaus that assign business credit scores:

FICO assigns a Small Business Scoring Service (SBSS) score from 0 to 300. Dun & Bradstreet assigns a PAYDEX score from 0 to 100. Equifax assigns three scores: a payment index from 0 to 100’ a credit risk score from 101 to 992’ and a business failure score from 1,000 to 1,880. Experian assigns a business credit score from 0 to 100.

If you’re in the market for a business loan, the FICO SBSS score is popular with banks for pre-screening, and most require a minimum score of 160. Without any business credit history, the highest possible score is 140, so you can’t rely on great personal credit to obtain a loan.

But remember, lenders could choose to pull any of your business credit scores, so it’s in your best interest to work on all four of them.

How business credit scores are calculated may be complicated, but building your business’s credit doesn’t need to be.

Follow these strategies to help collectively build business credit across all four bureaus.

Strategy 1: Set up an LLC or corporation